Oracle Assets streamlines operations and simplifies the management of

capital investments, automated business flows, calculate

depreciations, managing fixed assets cycle and centralized accounting

rules. Oracle Assets also integrates with external non oracle systems

to complete processing of asset transfers, disposals, reclassifications,

financial and tax adjustments, and legacy data conversions.

I have produced here end to end configuration of Fixed Assets module. This module is SOB / Ledger based. I have covered even from Sys admin so that users can duplicate and practice to configure entire FA module. Reader should know how to configure GL book / Ledger to practice this.

Oracle Assets integrates with

Oracle Payables – Automate asset additions as part of the procure-to-pay process to interface depreciable capitalized assets.

Oracle Projects – Track construction-in-process project costs and capitalize them via integration with Oracle Projects.

Oracle General Ledger – Central repository ledger to gather accounting and report.

Oracle Application Desktop Integrator – Create assets and import physical inventory from spreadsheets.

Steps to configure FA

1

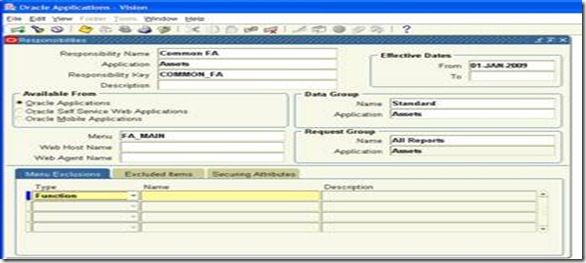

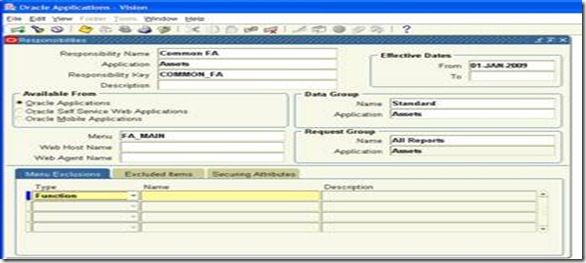

Define responsibility for FA – super user menu

Define this from Sys admin responsibility.

2

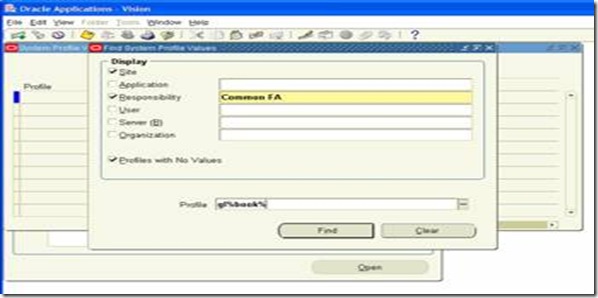

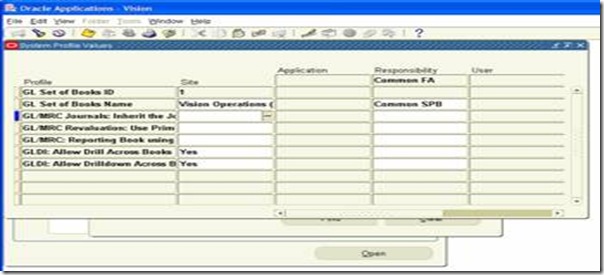

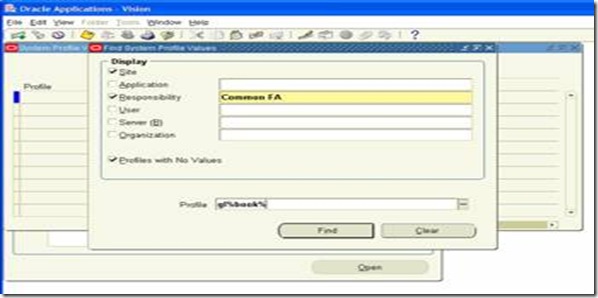

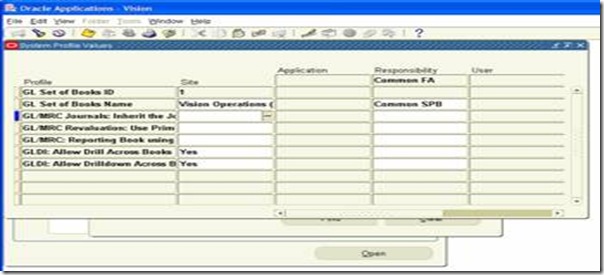

Attach GL book to your FA responsibility

Define this from Sys admin responsibility.

3

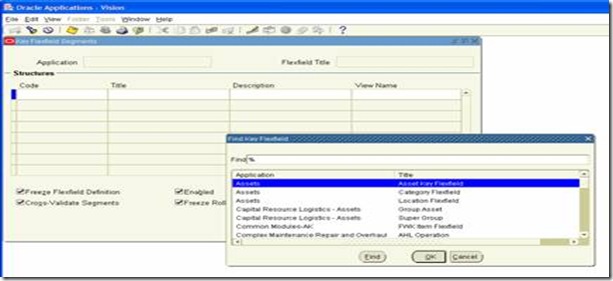

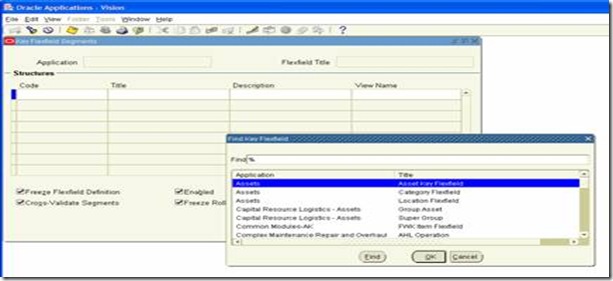

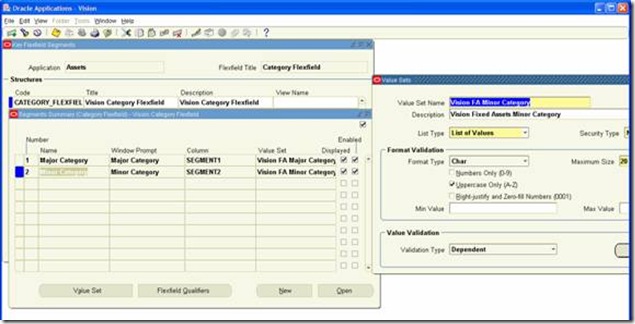

Configure 3 KFF - this is one per instance

Define this from Sys admin responsibility.

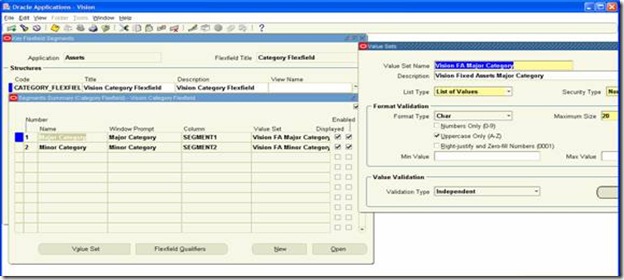

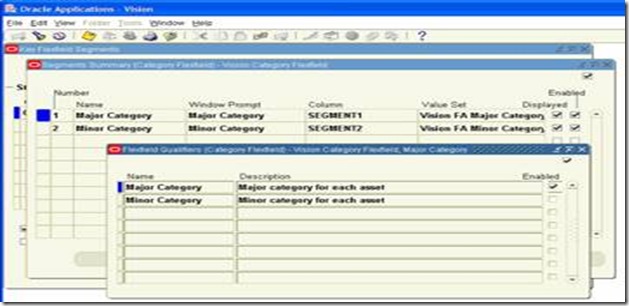

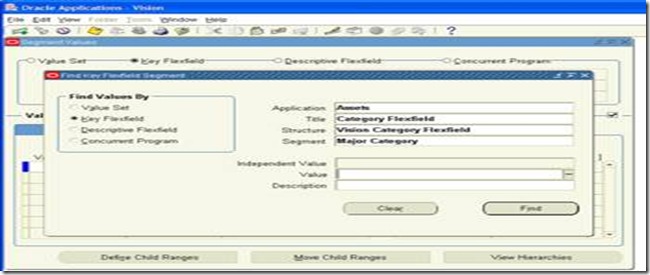

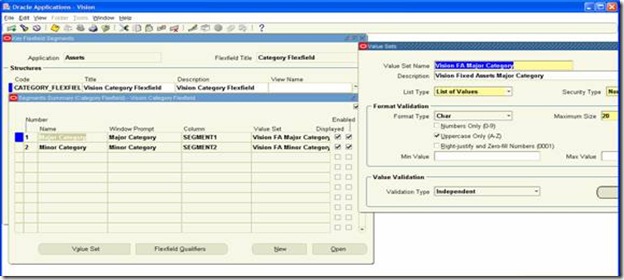

3 a – Category KFF

Always major category and minor category – two segments

Always major category – independent validation type

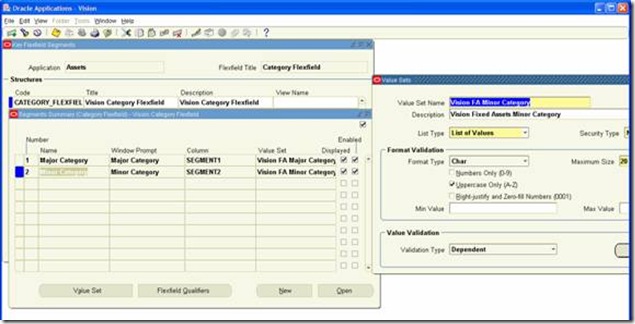

Always minor category – dependent validation type

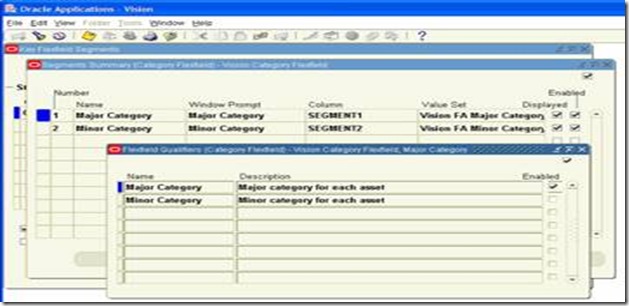

Major category Flexfield qualifier

Minor category will depend on major category

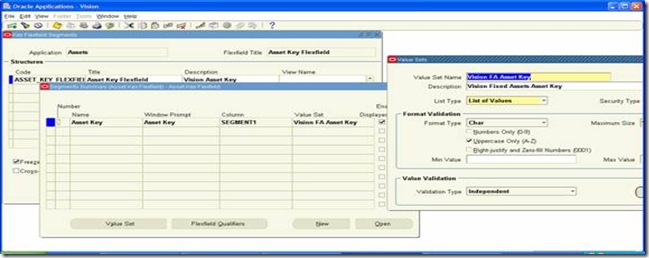

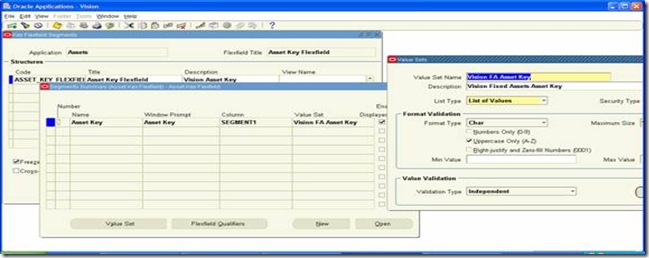

Assets key Flexfield

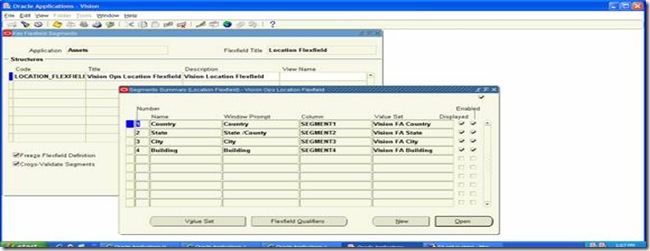

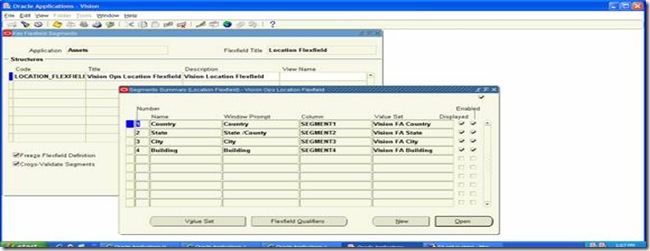

Location Flexfield

4

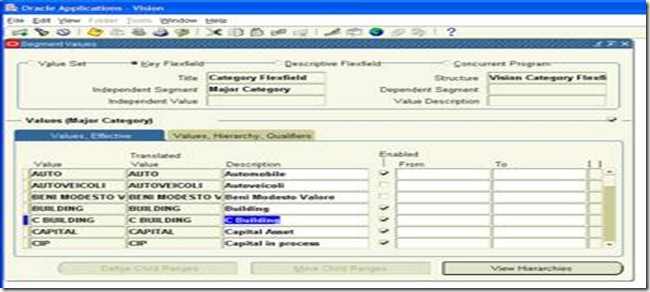

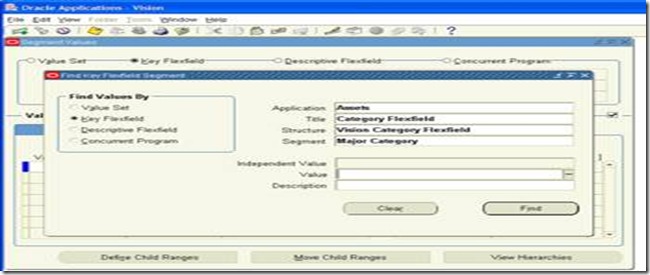

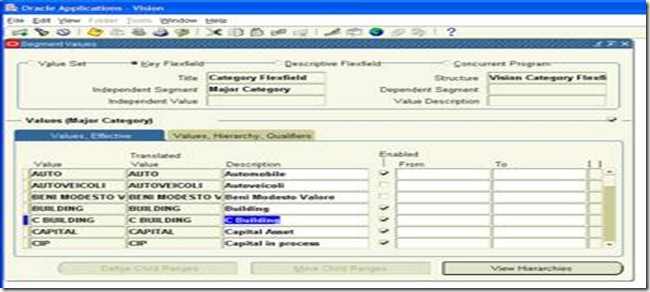

Define values for major and minor categories

Define this from Sys admin responsibility.

Define value for major category

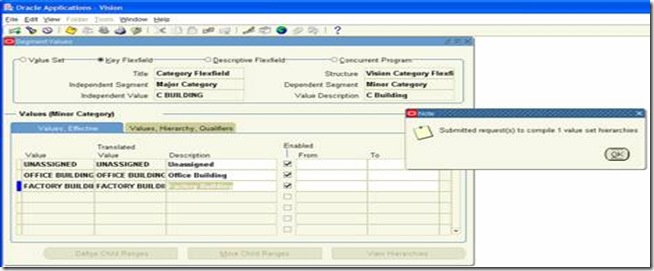

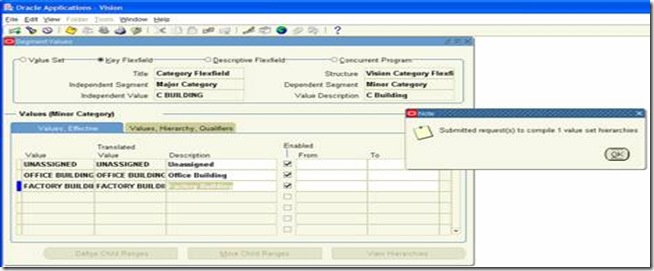

Defining values for minor category

5

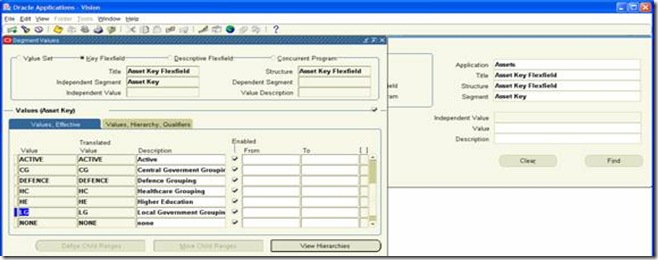

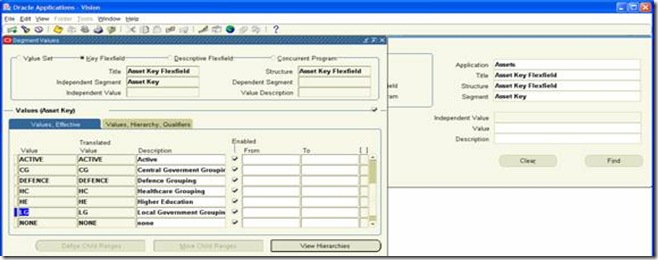

Asset key Flexfield values

Define this from Sys admin responsibility.

6

Similarly for location Flexfield values – define values for country, city, state and building

Define this from Sys admin responsibility.

7

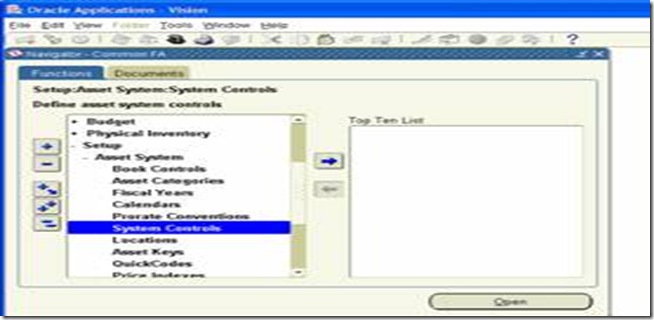

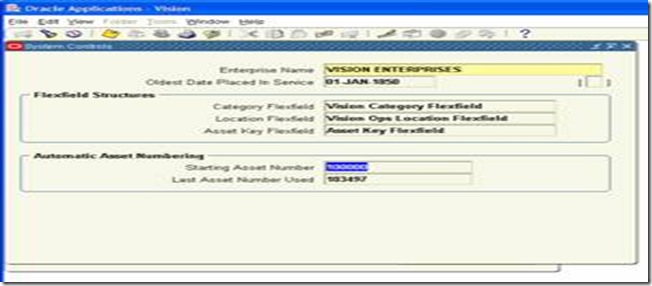

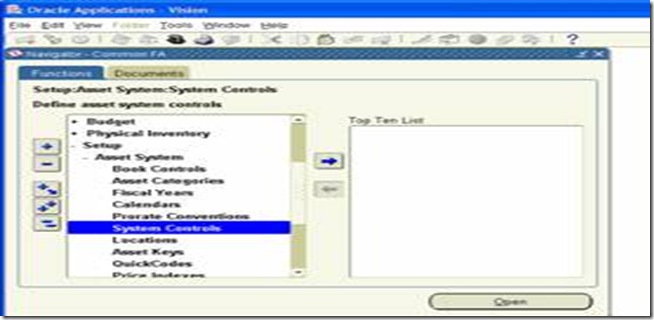

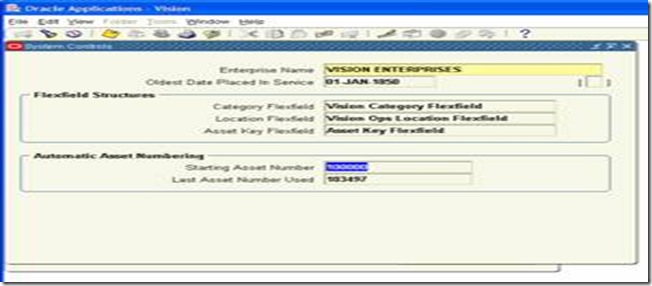

System control – one per instance

Define this in Oracle Assets module.

Grouping of 3 KFF and defining the assets number logic

Define the first automatic FA number and give provision for manual numbering (for data conversion from legacy to Oracle) while configuring the first auto number.

7

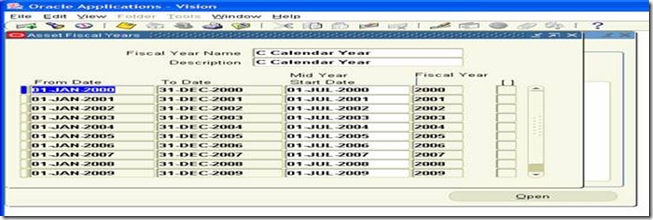

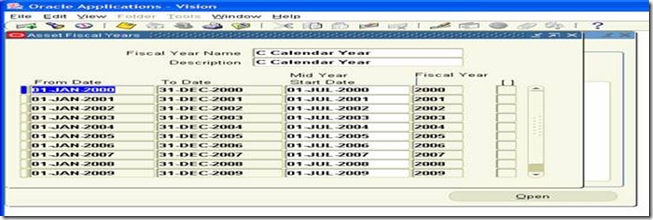

Define Fiscal year

Define this in Oracle Assets module.

Define the year based on the system control year

8

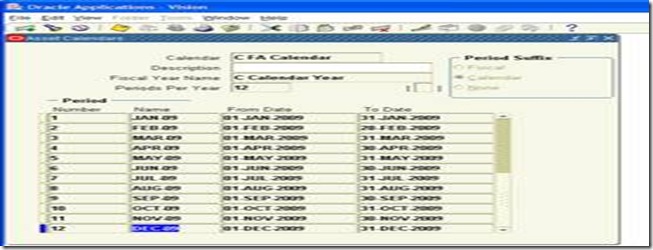

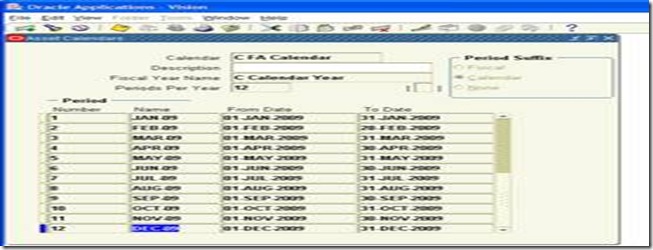

Define FA calendar

Define this in Oracle Assets module.

This name should be same as GL calendar name appears in GL calendar form

Attach FA fiscal year defined in earlier step while defining FA calendar

Always define at least one period before the first period put into use.

8

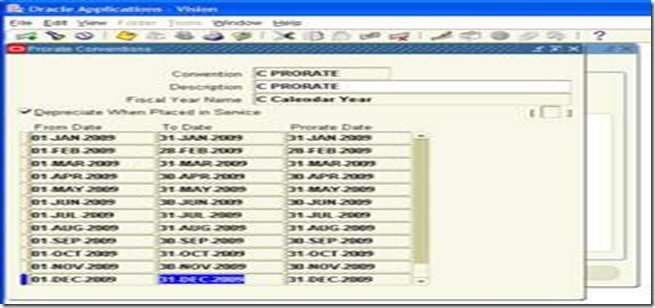

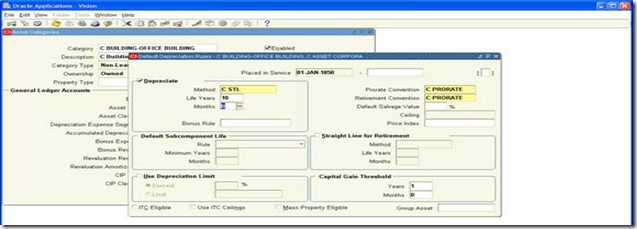

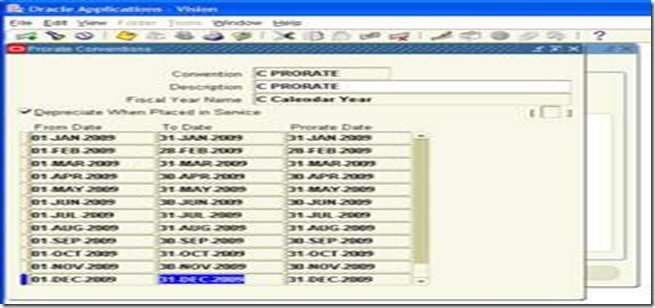

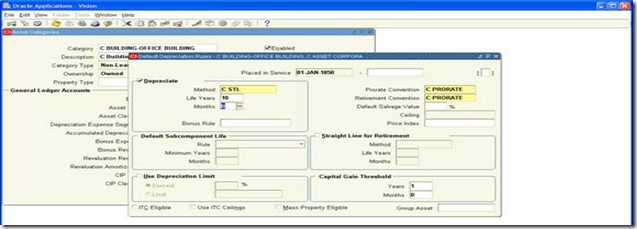

Prorate convention

Define this in Oracle Assets module.

The date when depreciation is to be calculated

9

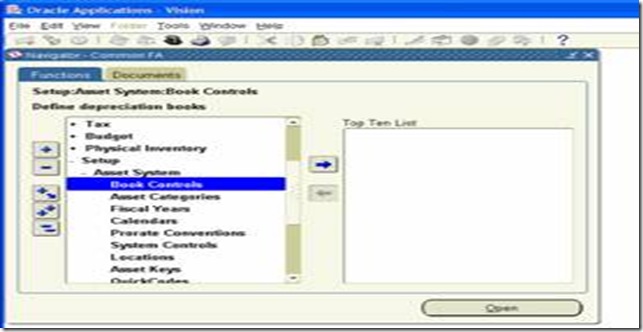

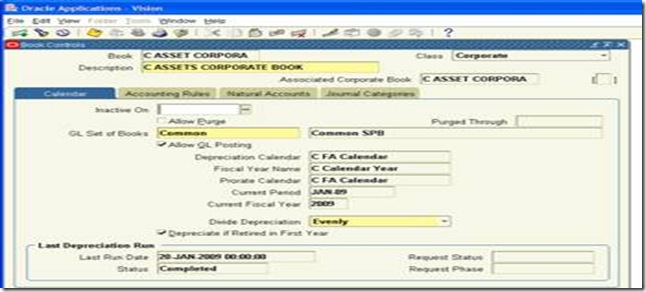

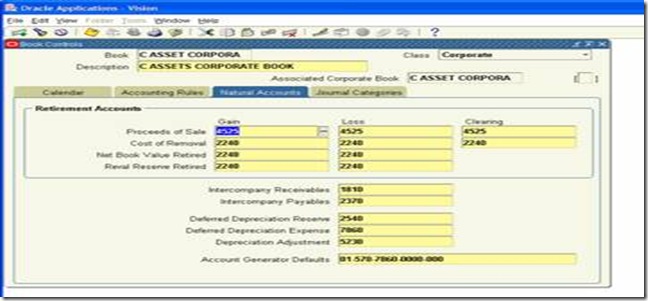

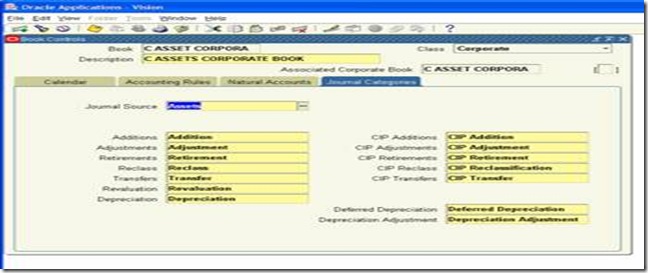

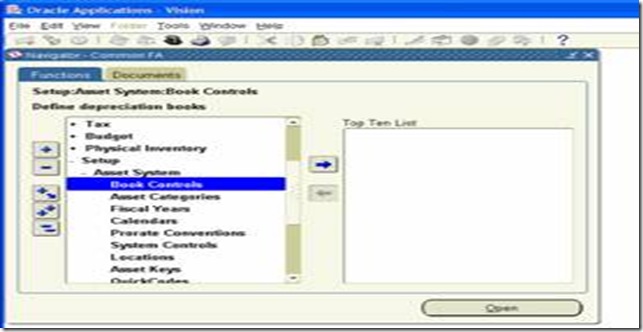

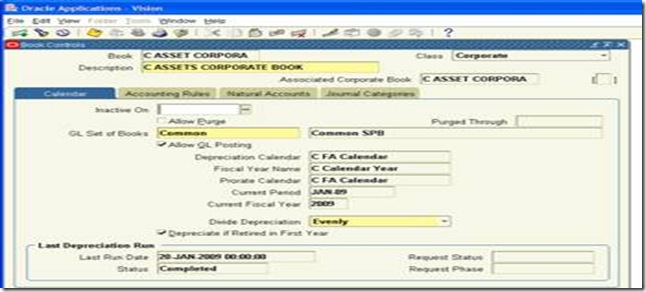

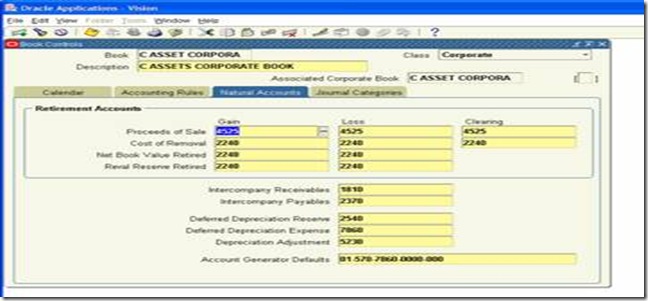

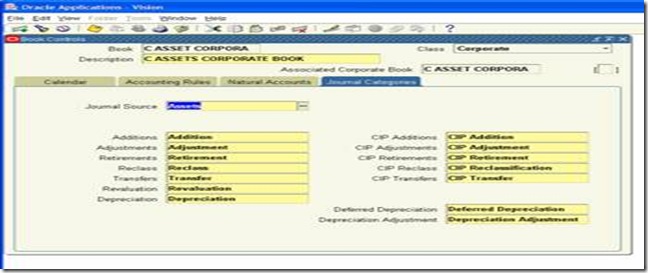

Define Corporate book

Define this in Oracle Assets module.

Defining Assets book – Corporate book

10

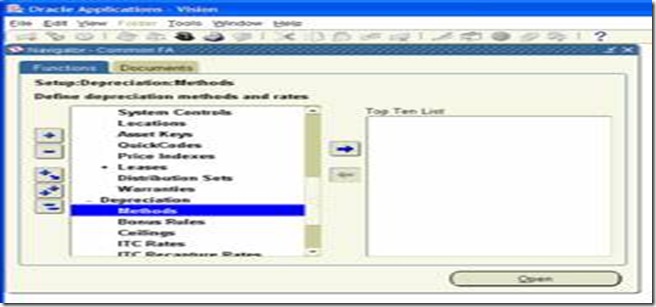

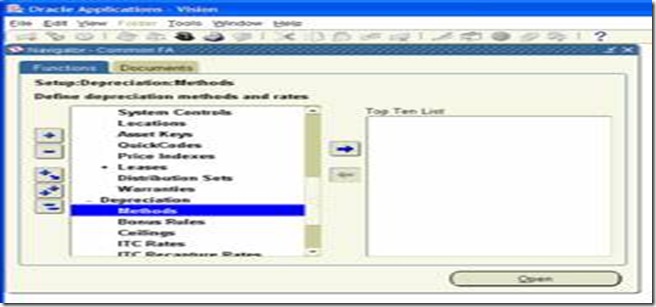

Define depreciation method

Define this in Oracle Assets module.

Oracle by default will have seeded depreciation methods – WDV, formula, STL etc

11

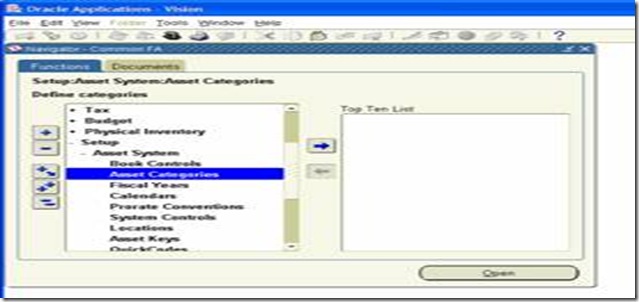

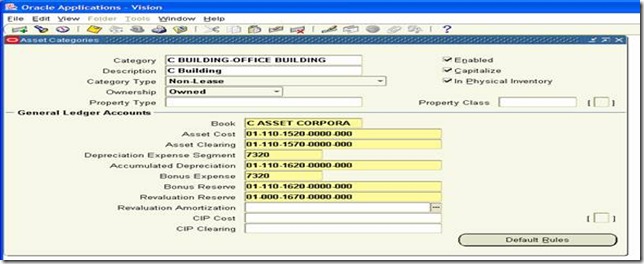

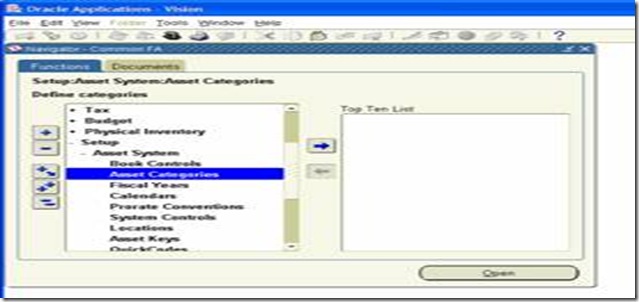

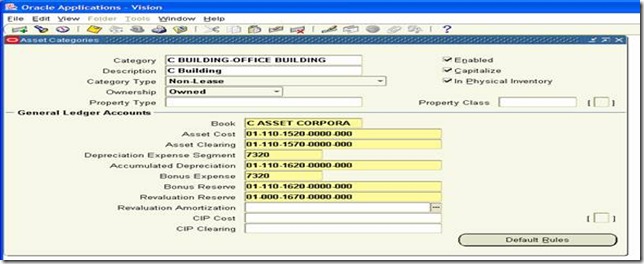

Define assets categories

Define this in Oracle Assets module.

Attach major and minor categories to our FA book with depreciation method

Here we define assets category with – major and min or categories, link to FA book and depreciation method, attach assets cost, depreciation account and asset clearing accounts.

or categories, link to FA book and depreciation method, attach assets cost, depreciation account and asset clearing accounts.

Attach depreciation

Important points

There is no open and close period in FA – it is based on AP

There are three ways to create assets in FA – One create invoice in AP and transfer to FA. Second manually create assets in FA and third quick assets creation in FA. However, second and third options are not recommended as we are force to create again invoice manually in AP. Also capital project invoice can be created from PA to FA.

I have produced here end to end configuration of Fixed Assets module. This module is SOB / Ledger based. I have covered even from Sys admin so that users can duplicate and practice to configure entire FA module. Reader should know how to configure GL book / Ledger to practice this.

Oracle Assets integrates with

Oracle Payables – Automate asset additions as part of the procure-to-pay process to interface depreciable capitalized assets.

Oracle Projects – Track construction-in-process project costs and capitalize them via integration with Oracle Projects.

Oracle General Ledger – Central repository ledger to gather accounting and report.

Oracle Application Desktop Integrator – Create assets and import physical inventory from spreadsheets.

Steps to configure FA

1

Define responsibility for FA – super user menu

Define this from Sys admin responsibility.

2

Attach GL book to your FA responsibility

Define this from Sys admin responsibility.

3

Configure 3 KFF - this is one per instance

Define this from Sys admin responsibility.

3 a – Category KFF

Always major category and minor category – two segments

Always major category – independent validation type

Always minor category – dependent validation type

Major category Flexfield qualifier

Minor category will depend on major category

Assets key Flexfield

Location Flexfield

4

Define values for major and minor categories

Define this from Sys admin responsibility.

Define value for major category

Defining values for minor category

5

Asset key Flexfield values

Define this from Sys admin responsibility.

6

Similarly for location Flexfield values – define values for country, city, state and building

Define this from Sys admin responsibility.

7

System control – one per instance

Define this in Oracle Assets module.

Grouping of 3 KFF and defining the assets number logic

Define the first automatic FA number and give provision for manual numbering (for data conversion from legacy to Oracle) while configuring the first auto number.

7

Define Fiscal year

Define this in Oracle Assets module.

Define the year based on the system control year

8

Define FA calendar

Define this in Oracle Assets module.

This name should be same as GL calendar name appears in GL calendar form

Attach FA fiscal year defined in earlier step while defining FA calendar

Always define at least one period before the first period put into use.

8

Prorate convention

Define this in Oracle Assets module.

The date when depreciation is to be calculated

9

Define Corporate book

Define this in Oracle Assets module.

Defining Assets book – Corporate book

10

Define depreciation method

Define this in Oracle Assets module.

Oracle by default will have seeded depreciation methods – WDV, formula, STL etc

11

Define assets categories

Define this in Oracle Assets module.

Attach major and minor categories to our FA book with depreciation method

Here we define assets category with – major and min

or categories, link to FA book and depreciation method, attach assets cost, depreciation account and asset clearing accounts.

or categories, link to FA book and depreciation method, attach assets cost, depreciation account and asset clearing accounts.

Attach depreciation

Important points

There is no open and close period in FA – it is based on AP

There are three ways to create assets in FA – One create invoice in AP and transfer to FA. Second manually create assets in FA and third quick assets creation in FA. However, second and third options are not recommended as we are force to create again invoice manually in AP. Also capital project invoice can be created from PA to FA.

No comments:

Post a Comment